What Are Performance Bonds? | A Quick, No-Nonsense Guide

If you are a principal contractor, you will likely be asked for a Performance Bond at some point by a Beneficiary or Housing Association. This article will give you all the information you need to know about securing a Performance Bond, including:

- What a Performance Bond is

- The different types of Performance Bonds you will be asked for

- How to secure a Performance Bond quickly and cheaply

What Is A Performance Bond & How Do They Work?

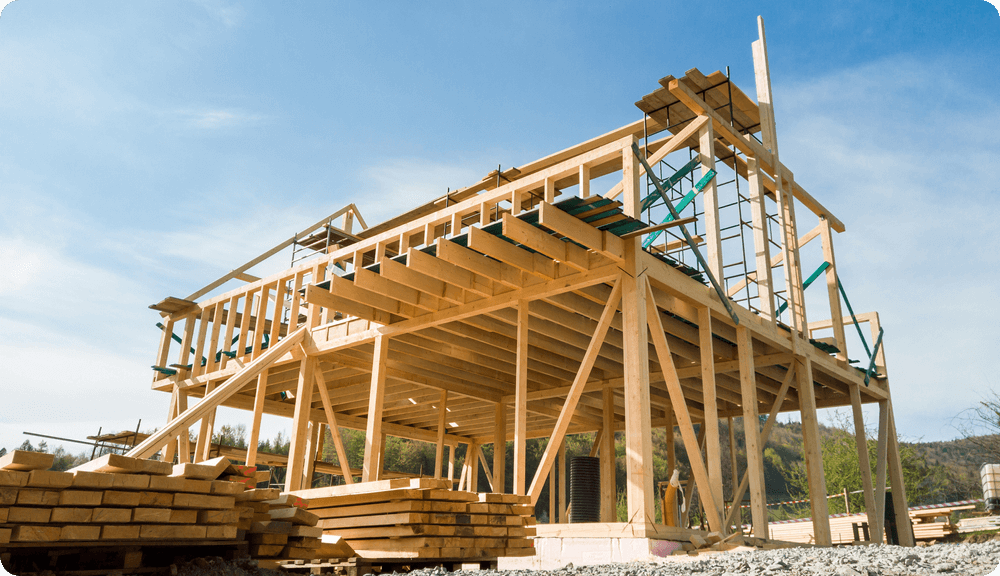

Performance Bonds are a type of Surety Bond, designed to ensure that the parties involved in a contract, often in the construction industry, fulfill their obligations as specified in the agreement. They act as a guarantee given by a third party, such as a financial institution like an insurance company or bank. Acquiring a Performance Bond offers a level of protection against risks.

A Performance Bond guarantees that the construction project or job will be completed as per the terms and conditions outlined in the construction contract and ensure satisfactory completion. For this reason, they are also sometimes referred to as Contract Bonds or Performance Guarantees.

Performance Bonds offer protection to the project owner or obligee, typically by providing financial security in case the contractor or principal fails to meet their contractual obligations.

For example, a contractor working with a housing association on a development for a large number of plots will very likely be required to obtain a Performance Bond by the housing association to guarantee financial security and that the work will be completed.

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Advance Payment Bond

The second most common surety bond, after Performance Bonds, is an Advance Payment Bond. Advance Payment Bonds guarantee that when a project is completed, a party will pay all parties involved, including suppliers, labourers, and subcontractors.

Click here to learn more about the Advanced Payment Bonds we provide.

In What Other Sectors Would You Find a Performance Bond Requirement?

Performance Bonds are also sometimes utilised in large fit-out and renovation projects and for renewable energy projects.

They are also used in commodity contracts. In such situations, a buyer will request a Bond from the seller to guarantee that, if the item or service is not delivered, the buyer will be compensated for any expenses that are lost.

What is An ABI Performance Bond?

The Association of British Insurers (ABI) provides specific and standardised template wording for Performance Bonds. An ABI Performance Bond is a Bond that uses this standard wording.

The most common Performance Bonds we deal with are in ABI standard wording, and many beneficiaries/housing associations request them to be worded in this way.

However, if an ABI Performance Bond isn’t right for your situation, then we can procure a Performance Bond for all other non-ABI wordings.

What is An On-Demand Performance Bond?

An On-Demand Bond is another type of Performance Bond. What makes On-Demand Bonds different is that they do not require the beneficiary (typically the project owner or client) to provide evidence of a breach of contract or to fulfill specific conditions to trigger the Performance Bond.

With On-Demand Performance Bonds, the beneficiary can make a claim and receive payment from the bondsman immediately upon first written demand for payment, provided they follow the bond documents.

The beneficiary does not need to show evidence of non-performance or contractual violation. In essence, it is a more straightforward and immediate form of financial guarantee for the beneficiary.

What Is A Conditional Bond?

The conditions under which a Performance Bond becomes enforceable are detailed within both the Bond wording and the contract. This may include the following scenarios:

- The original contractor’s failure to complete the project within the contract term agreed-upon timeframe.

- Failure to meet specific quality or performance standards outlined in the contract.

- The contractor defaults or inability to pay subcontractors and suppliers.

- Other specific conditions are stipulated in the contract.

Where Can I Get A Performance Bond?

We have a 100% track record of helping our clients secure Performance Bonds, regardless of their financial status. We are also proud to say we have the largest network of underwriters, and therefore, will be able to offer you the best terms.

Alternative options to a Performance Bond include:

- Increased retention — This involves the beneficiary/ employer holding back money and only releasing it when the project achieves agreed milestones or upon practical completion.

- No Performance Bond requirement — This is in extremely rare circumstances.

Do I Need A Performance Bond?

Many government contracts and large-scale projects also require Performance Bonds as part of the bidding and contracting process.

If you are a beneficiary, you may need a Performance Bond in place as a form of risk management or risk mitigation. This means that, if the contractor fails to fulfill their contractual requirements, the Bond will cover the work that needs to be completed.

This usually means covering the costs of hiring a replacement contractor to complete the project without any additional financial burdens.

A Performance Bond will also cover you against the insolvency of the contractor, should this happen.

Securing a Performance Bond displays financial strength and credibility, allowing you to gain an edge over the competition and secure a deal on a project. After all, if you’re offering a performance bond and the others are not, you’re essentially telling any beneficiaries that they can rely on you for extra security and protection.

If you’re a contractor, then a Performance Bond is a great way to enhance your credibility and to show that you are financially stable and committed to finishing a project. This, in turn, will give your clients and the project owners peace of mind, as it means their investment will be protected.

What Are the Advantages of Performance Bonds?

The advantages for the employer are risk mitigation and financial protection. Whereas for the contractor, the benefits are that they can help secure contracts, when they aren’t a contractual compliance, and they are also a great way to build credibility and trust.

What Are the Disadvantages of Performance Bonds?

Ask an expert what the potential ‘disadvantages’ are and they’re likely to say the following. (We don’t think these are disadvantages, for reasons we’ll explore at each point):

- Performance Bonds cost money — for housing associations, there are premiums to be paid. For example, you’ll have to pay an underwriter’s fee, and we’ll also have to charge a fee for bringing everything together. So yes, there is a cost involved, but it’s only a small percentage of the bond amount. The financial protection you’ll get with a Performance Bond by far outweighs the negatives. Read more: how much does a Performance Bond cost?

- They can delay projects — if the underwriter requires more financials from you, this could potentially slow things down and delay the project. However, if time is of the essence, we can help speed up the process by fast-tracking the process of finding an underwriter — something that we have a 100% track record of doing with our clients.

- The claims process can be complex for beneficiaries — if the contractor goes insolvent or cannot complete the project it can sometimes be difficult to complete a claim (factors include what’s happened on the site, and who the underwriter is, for example). However, we can help you make a claim quickly and easily if this happens.

Performance Bonds and More from CG Bonds Surety

If you’ve ever been asked ‘what is a Performance Bond?’ or asked to get a Performance Bond and are struggling due to hardened market conditions, please give us a call, send an email, or complete our application form. We guarantee you’ll secure a Performance Bond with us, at the lowest price possible.

View the other Construction Bonds that we offer here.

Fill in our application form — it’s quick & easy, and we’ll help if you get stuck